What is an SME Business?

Table of Contents

Did you know that of the UK’s 5.98 million businesses, around 5.97 million are SMEs? But what is an SME, and why does it matter?

Learn what an ‘SME’ is in business contexts in this article and find out how it impacts your very own organisation. Discover:

- What is an ‘SME’?

- How are SMEs categorised?

- Where do sole traders fit into this definition?

- What does being an SME mean to my business?

- How to run your small business more efficiently

What is an ‘SME’?

An ‘SME’ stands for ‘small and medium-sized enterprises’. Collectively, SMEs across the UK employed nearly 17 million people and generated a turnover of over £2.2 trillion at the start of 2020.

What makes a business ‘small’ versus ‘medium’ is up for debate. The categories can seem a little random or meaningless at times, and there is a huge spectrum in quite how small ‘small’ can be. However, drawing lines between different sized businesses helps the government find which businesses are struggling and need support. We discuss how these lines are drawn and how they impact your business in the forthcoming sections below.

How are SMEs categorised?

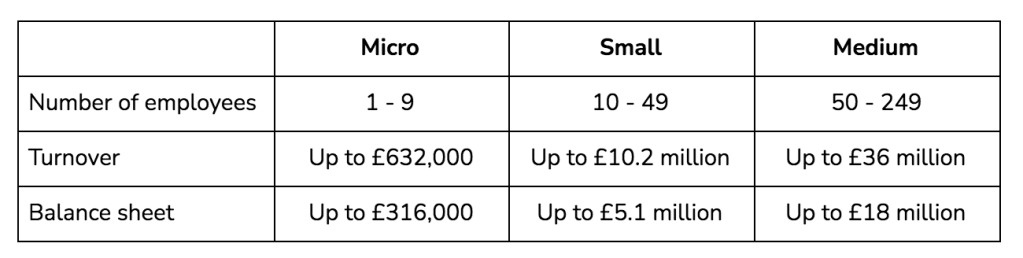

SMEs are categorised according to various factors, and the exact boundaries may change according to different sources. We’ve taken the same three measures used by the UK government and Companies House to determine different enterprises’ sizes. Using these measurements, the following three categories of SMEs are available: Micro, Small and Medium.

Number of employees

The number of employees a business has is the leading tool in measuring the size of an organisation.

Micro-businesses have between one and nine employees. Company directors are counted as the first employee for most practical purposes, so if you’re the only one running your company, you’ll be considered a micro business with Companies House.

At 10 and above, an enterprise becomes a small business until it reaches 49. From 50 to 249 employees, a business is considered medium-sized.

Turnover and balance sheet

‘Number of employees’ is something of a blunt measure as a business can have a very small team but be very successful and earn lots of money. For this reason, other factors like the business’ turnover and balance sheet are used to understand where certain organisations blur the lines between ‘micro’, ‘small’ and ‘medium’.

Micro-businesses typically have a turnover of up to £632,000 and a balance sheet of around half this at £316,000. This balance sheet ratio being half of an organisation’s turnover is maintained as comparisons are scaled up to include other businesses.

Small businesses have a turnover of up to £10.2 million with a balance sheet of £5.1 million and at the upper end of this system, medium businesses have a turnover of up to £36 million with a balance sheet of £18 million.

In summary

This gives the following outline of what different SMEs are within the UK:

In most contexts, you can call your business ‘micro’ or ‘small’ if you fit the employee category. The other categories of turnover and balance sheet are primarily used by Companies House to determine how detailed and regular your annual accounts reporting should be. Note that, this does not apply to sole traders as they’re not companies and don’t interact with Companies House.

Where do sole traders fit into this definition?

Sole traders can be included in the above SME categories if they have employees: as of early 2020, around 229,000 UK sole traders are employers. However, employers are typically limited companies so most sole traders are included in a category of their own.

If you run your business on your own as a sole trader, your business is categorised as an SME with no or ‘zero employees’. In fact, this is the largest category with around 3.47 million UK businesses according to the latest figures.

What does being an SME mean to my business?

As an SME (including if you have no employees or are in the ‘micro’ category), you can receive government support to help your business grow.

If you’re just starting out, you qualify for the UK Start Up loan or other financial and strategic support depending on where you live. Even beyond this, governments always seek to help small businesses how they can as they contribute trillions of pounds to the economy and support millions of families and communities.

On a more practical note, as your business grows, you’ll likely transition to become a limited company. Here, the size of your business will become important as the rules for the quality of your annual company accounts change according to your business’ size. And so, where your business lies along the SME spectrum impacts you in a variety of ways and throughout your business’ life.

How to run your small business more efficiently

When you’re establishing your very own SME, you can gain a business advantage from getting time back from your financial admin. Thousands of UK business owners are using the Countingup app to automate their accounting and admin and run their business more efficiently.

Countingup is the business current account and accounting software in one app. It automates time-consuming bookkeeping admin tasks for self-employed people across the UK. With instant invoicing, automatic expense categorisation, receipt capture tools and cash flow insights, you can confidently keep on top of your business finances and save yourself hours of accounting admin, so you can focus on doing what you do best.

The Countingup app even provides tax estimates and is compatible with sole traders and limited companies.

Find out more here and sign up for free today.

Receive actionable business tips weekly

By submitting this form, you confirm that you are 16 years of age or over and that you have read and agree to our Privacy Policy. You can unsubscribe at any time.