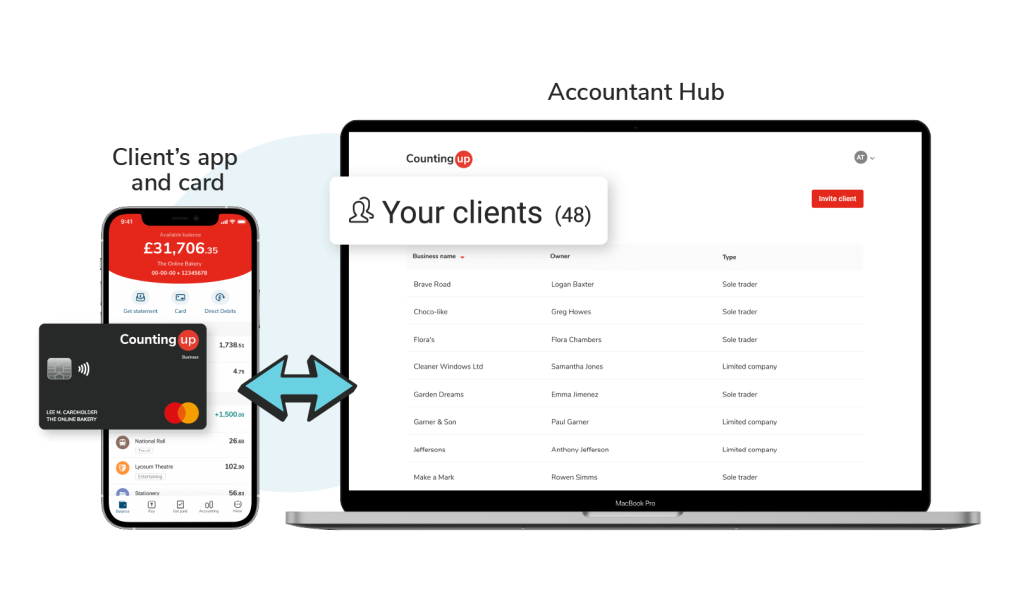

Increase efficiency with all your client data, in one place

Clients with a Countingup business current account can connect directly to your Accountant Hub account. That way, you always have instant access to up to date transaction data – no more nagging for missing information. Year ends are now easy.

It’s a much easier switch for a sole trader or small business client to open a new business current account than it is to get them to set up accounting software. In less than 4 minutes they can have a new business account they can invoice from and pay expenses with from their phone.

With all their business transactions in one place – invoices, bills and expenses, you can manage their accounting for them and file their tax returns online.

There’s no cost for accountants and bookkeepers to use Countingup to manage client accounts. Your clients pay a small monthly fee for their Countingup business account, but you don’t pay to use the built in accounting software.

Getting started with Countingup’s free accounting software takes just a few minutes. Invite your clients to open their Countingup business account and start working smarter and faster together straight away.

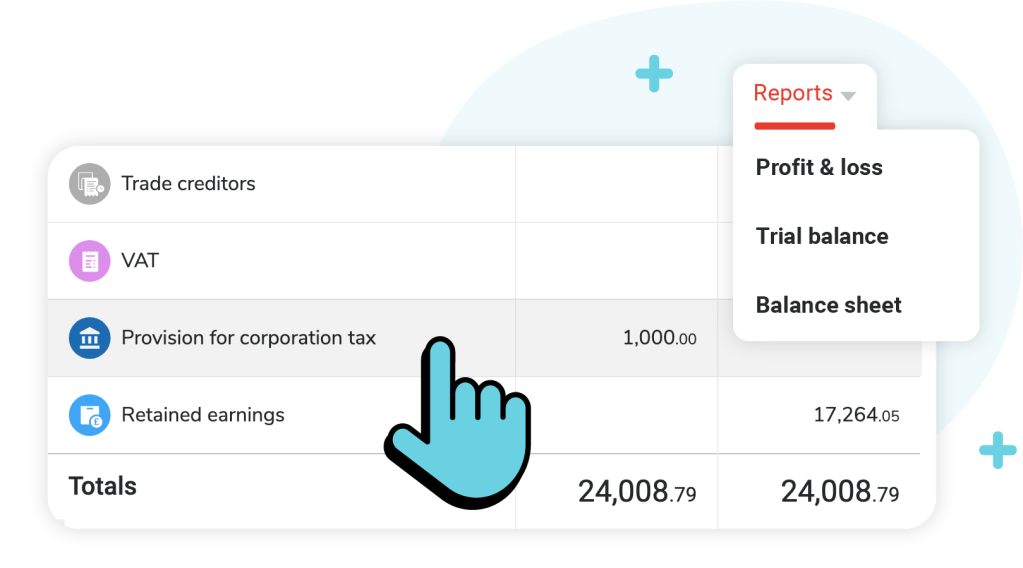

The reporting functionality is perfect to help small entities complete their year end submissions. Countingup is an accounting software package ideal for working with small clients and sole traders.

Chris Wade, Lealindis Ltd

Start using the accounting software that makes it easier to manage small business clients